ATLANTA, December 22, 2020 – The Paycheck Protection Program (PPP), a large U.S. government stimulus program and the hallmark of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, provided forgivable loans to small businesses to help these businesses weather the COVID-19 pandemic. New research from Emory University Goizueta Business School professor Tetyana Balyuk explores how PPP funds were “piped” to small businesses, in particular small publicly listed firms, and finds several pitfalls in the design of the PPP delivery.

The research shows better quality forms found the hidden costs—including potential audits and investigations—too onerous to make use of the funding whereas intermediaries, especially big banks, delivered PPP funds quicker to larger firms.

The $669 billion PPP program started this spring as government relief for small businesses with less than 500 employees. The Small Business Administration (SBA) delivered the relief through private lenders from April to August 2020. The funds are forgivable if the firms spend the money on eligible expenses such as payroll or rent. The funds convert to 1% loans if not forgiven. The idea behind the PPP was to provide a lifeline to vulnerable small businesses in the midst of a sudden and deep economic contraction triggered by COVID-19.

Researchers from Goizueta, The Johns Hopkins Carey Business School, and Duke University’s Fuqua School of Business looked at 678 publicly listed PPP recipients. They also investigated 100 firms that returned the PPP loans to the SBA without using them. The research uncovered that PPP funds seemed like a good deal for small businesses because they were cheap and boosted share prices of firms. However, the fallouts from regulatory scrutiny created fears about hidden costs among PPP recipients and made new applicants wary of PPP. Firms that were demonstrably financially stronger before the COVID-19 pandemic sought release from these hidden costs by returning PPP funds and saw large increases in valuations. The net effect of these concerns was a concentration of PPP funds among less viable firms.

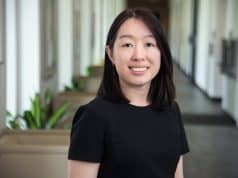

The research also found that larger firms gained early PPP access. These patterns indicate the importance of the role of and frictions in the financial intermediaries such as banks that were charged to deliver PPP funds. “While the PPP program was created for small businesses, the larger the business and larger the bank with which the firm did business, the earlier the firm received the funding,” said Tetyana Balyuk, Assistant Professor of Finance at the Goizueta Business School. “In the initial funding round, small businesses seemed to have a harder time getting funding through large banks. The second round of PPP funding reached more small firms.”

The researchers concluded that how the funds are delivered matters, especially when attempting to reach small business owners. Moreover, the strings attached to these funds also matter. It is for this reason some small businesses were reluctant to take PPP loans. While highlighting the pitfalls of implementing the PPP funding, researchers provide a set of tangible recommendations for policy design.

“We found that the PPP has the hallmarks of a well-designed program. This includes transparent eligibility criteria and very attractive terms that firms’ stakeholders perceive favorably. While these features should make the program broadly accessible, we find that its delivery was shaped by the concerns and incentives of its key participants,” says Balyuk. She adds, “We believe that objective standards are important for design of government aid programs. Moreover, transparency in ex-post scrutiny is as important as carefully crafted eligibility requirements. Delineating safe harbors may be an appropriate tool in the design of similar programs in the future.”

About Goizueta Business School at Emory University

Business education has been an integral part of Emory University’s identity since 1919. That kind of longevity and significance does not come without a culture built around success and service. Emory University’s Goizueta Business School offers a unique, community-oriented environment paired with the academic prestige of a major research institution. Goizueta trains business leaders of today and tomorrow with an Undergraduate degree program, a suite of MBA programs (Full-Time One-Year MBA, Full-Time Two-Year MBA, Evening MBA, and Executive MBA), a Master of Science in Business Analytics, a Doctoral degree, and a portfolio of non-degree Emory Executive Education courses. Together, the Goizueta community strives to solve the world’s most pressing business problems. The school is named for the late Roberto C. Goizueta, former Chairman and CEO of The Coca-Cola Company.