For most of us, finance is complex. Yet making financial decisions is part of day-to-day life.

Take mortgages. Around 60 percent of U.S. households have a home mortgage, but how many actually understand its real value? Calculating things like interest rate trade-offs or closing costs is not easy, and research finds that a majority of families make financial mistakes because they fail to understand benefits or savings that might be open to them in refinancing.

There are ways to overcome this kind of “information friction”—the obstacles to understanding that make it hard for people to process complex financial ideas and concepts. One of these is education. Ensuring that people have direct access to clear information can help inform household decisions. That seems pretty basic.

Another, perhaps less understood, mechanism is the “peer effect”—the way we learn from and are influenced by what our peers or colleagues say or do.

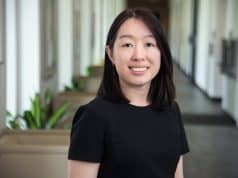

A new paper published in the Review of Financial Studies by Gonzalo Maturana, associate professor of finance, takes a fresh look at how the peer effect can help households make better decisions about their mortgages. And he finds that work colleagues and associates can actually have a far greater positive impact on our financial outcomes than we might expect.

Together with Jordan Nickerson from MIT’s Sloan School of Management, Maturana ran a large-scale study of a particular U.S. peer group: public school teachers employed by the state of Texas.

High school teachers are fairly representative of the national population in terms of salary and income, enabling Maturana and Nickerson to look at a relatively typical group and explore peer dynamics. As a group, teachers also have the advantage of working to timetables, meaning that it is easier to determine the precise moments that there could be an overlap in people’s schedules—downtime for interacting and sharing information in the teachers’ lounge.

Maturana and Nickerson levered a huge amount of information for the study in total. Each teacher’s employment records included each individual’s demographic identity, together with subject specialism and school timetable activity at a granular level.

This data set was then merged with county-wide voter rolls and county deed records to analyze refinancing actions over time.

Amassing so much data was a necessary challenge, said Maturana.

“Empirically, it’s really tough to identify a reliable peer group and then know exactly when people are interacting socially and what the outcomes of that interaction might be. We had to capture as much information as possible in order to be sure of our findings.”

What they found, however, is striking.

Where there was a lot of mortgage refinancing going on among teachers in a particular school, individuals were a stunning 20.7 percent more likely to refinance their own mortgage. In other words, they were far more disposed to investigate alternatives and take advantage of the better deals on offer. The peer effect was also a critical factor in their subsequent choice of mortgage lender.

But that’s not all.

Maturana and Nickerson also found that the more savings a particular peer group was making in mortgage repayments, the more refinancing activity there was in that school or teacher network.

It is clear. With financial decisions, the network effect can create a positive feedback loop, said Maturana.

“The simple dynamic of sharing information and understanding with others who are like us in some way can have a powerful, positive impact on our ability to process complex financial matters and drive a series of better outcomes for families. Good decisions create more good decisions.”

Allowing for some variation in demographics and education levels, Maturana and Nickerson are confident that their findings can be externalized at the U.S. population level—with interesting implications for policy makers and mortgage lenders, they believe.

“We’ve established that there’s a strong multiplier effect that’s down to peer networking. When people have a positive experience, they’re more likely to share it. Buying a house and taking out a mortgage is complex, and families are prone to making mistakes. The peer effect can mitigate this. If policy makers are interested in driving better household financial decisions, they would do well to have the peer effect on their radar.”

The same goes for responsible banks.

“Banks will want to be aware of the power of peer networking when people are looking for a lender, for sure. But there’s also an opportunity here for mortgage lenders to play a positive social role in educating their customers and having them share clear, valuable and transparent information across their networks.”

Maturana’s paper, “Teachers Teaching Teachers: The Role of Workplace Peer Effects on Financial Decisions” was awarded the Rising Scholar Award by the Review of Financial Studies in 2020.