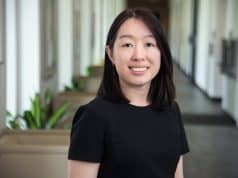

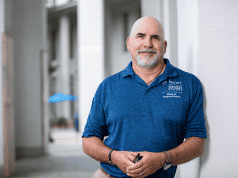

A recent Financial Times article referenced research completed by Goizueta Business School Assistant Professor of Finance Breno Schmidt and Luis Goncalves-Pinto, a colleague from the National University of Singapore. The article examined the commonality of in-house trades made to protect distressed funds in danger of needing to sell assets at a discount relative to current market prices. Their paper suggests that managers might be coordinating trades in order to protect each other against liquidity shortfalls, which could violate their fiduciary duty to investors.

The research by Schmidt and Goncalves-Pinto, Co-Insurance in Mutual Fund Families, found that trades similar to those addressed in the Financial Times article tend to occur more often within mutual fund families with a large number of funds. The researchers also studied the effects of co-insurance on the actions of investors and fund managers. They found that decision makers in large families took more risk than those in small families.

Click here to read the Financial Times article ‘No surprise at backroom dealing charge’