A new tax bill making its way through the Georgia legislature would change the look of the tax code. But lawmakers differ on how much it could help the economy in a state with has stubbornly-high unemployment.

Traditionally Republicans and Democrats have not seen eye to eye when it comes to taxing businesses or adding wealth back to the economy via lower taxes. An overhaul of the system could include better tax breaks for small businesses. Republicans argue that will spur job growth while Democrats worry about the affect on long-term revenue.

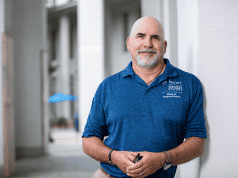

According to Goizueta professor Tom Smith, who spoke late last week with Denis O’Hayer of WABE radio, there’s no right or wrong in the disagreement.

“There’s no simple answer,” he said. “Part of the issue has to do with how tax cuts are arranged — who’s doing the tax cuts and the time frame over which you look at the tax cuts. You can answer the question with both a yes and a no.”

Smith said cuts designed in a way to incentivize using monetary savings in hiring workers show results in creating jobs but “that’s usually where the rubber doesn’t meet the road,” he said.

“Very specific tax cuts lead to very specific reactions from companies,” he said. “Very broad tax cuts lead to less-specific actions. The downside of that is people say the government is trying to control what companies to… that creates another set of hostilities.”

It will take compromise since data can be used to support both arguments.

“We live in a world of grays but politicians certainly like to live in a world of black and whites,” Smith said. “Unfortunately, it’s not that simple.”